Macy’s Closings Could Raise Risk for Billions in CMBS Mall Debt

A bidding war for Macy’s, concurrent with the retailer’s plan to close 150 stores, has significant implications for shopping mall owners and the loans financing these centers. While a buyout could be beneficial with a financially strong new owner, closures may spell trouble for malls and lenders. Macy’s anchors numerous malls, totaling over 100 million square feet, with about $24 billion in loans linked to these properties. The potential closure of Macy’s stores could lead to reduced foot traffic, lower sales for neighboring tenants, and decreased revenue for landlords. Weaker-performing malls are likely targets for closures, exacerbating their decline. Co-tenancy clauses triggered by anchor store closures could affect inline tenants, potentially leading to reduced rents or concessions. Overall, these developments indicate possible repercussions for mall viability and associated loans.

More Than 16,000 NYC Hotel Rooms Used To Accommodate Unhoused

In response to the housing needs of the unhoused, refugees, and migrants, over 16,000 hotel rooms in New York City have been repurposed, with 140 hotels no longer available for travelers as of October. Various city and county authorities have secured these accommodations through long-term leases, reducing future hotel room supply. The impact is particularly noticeable in different market segments, with a concentration of projects in major areas like midtown, Queens/Brooklyn, and JFK/Jamaica. The transformation of these hotels, most of which were midscale or economy properties, may have a lasting effect on New York City’s hotel performance, potentially leading to higher average daily rates in the future. Despite ongoing construction, the city’s supply pipeline for new hotels is expected to be limited due to recent zoning and development regulations.

Amazon Ratchets Up Warehouse Sublease Offerings Offsetting Newly Leased Space

Amazon has vacated over 14 million square feet of distribution space in the U.S. in the past 16 months, constituting about 3% of its U.S. logistics footprint. Most closures occurred in the latter half of 2022 as Amazon focused on shutting down older, less efficient facilities. The company has recently increased its sublease offerings, with the unique aspect being that more of these involve opportunities through 2030 and beyond in larger, newly built distribution properties. Despite these closures, Amazon’s total U.S. logistics square footage appears to remain stable in 2023, with new leases offsetting the volume of closures.

Consumer Confidence Slips for Fourth Month, Retailers Expand Seasonal Hiring, Jobless Claims Edge Lower

Consumer sentiment in the U.S. declined for the fourth consecutive month, with the University of Michigan’s sentiment index dropping to 60.4 in November, down from 63.8 in October. Concerns about high interest rates, inflation, and global political unrest contributed to the decline, particularly affecting lower-income and younger consumers. Despite retailers adding 3% more jobs in October compared to the previous year in anticipation of the holiday season, transportation and warehousing jobs fell by 27%. Additionally, while initial claims for unemployment insurance remained low at 217,000 for the week ending Nov. 4, continuing claims increased for the seventh consecutive week, suggesting challenges in finding new employment for some individuals.

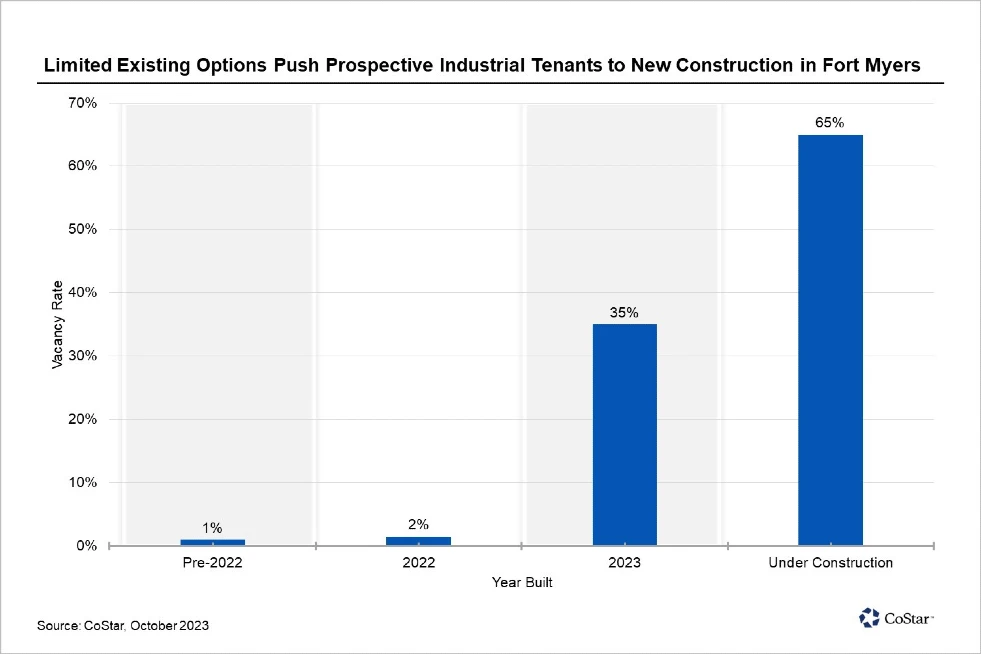

Swollen Construction Pipeline Could Cause Jump in Fort Myers Industrial Vacancy

Fort Myers, in Southwest Florida, has seen significant activity in new industrial development with 3.9 million square feet currently under construction, following the completion of 1.4 million square feet. However, recent completions have surpassed tenant move-ins, leading to a slight increase in vacancy rates to 2.4%, marking the first time the vacancy rate has averaged over 2% in a year. It’s projected that the vacancy rate will continue to rise, potentially peaking at around 6% by the end of 2024. Despite this increase, Fort Myers remains a desirable industrial market with strong tenant interest, particularly for spaces under 50,000 square feet. Vacancy is expected to normalize to 2% to 3% in the long term.