In the News

Commercial real estate industry grows more upbeat, NAIOP survey finds

The commercial real estate industry is showing renewed optimism, according to a NAIOP survey, as professionals anticipate favorable borrowing conditions and increased deal activity over the next year. Following a challenging period due to rising interest rates, respondents are optimistic about metrics like occupancy rates, rents, and the availability of equity and debt, with industrial properties expected to be the most active, followed by multifamily and data centers. However, the outlook for the office sector remains negative, and concerns about the upcoming U.S. presidential election add uncertainty to the market. Overall, expectations of declining interest rates are seen as a key factor driving this positive sentiment.

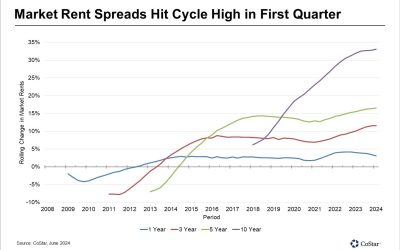

Shopping Center Owners Take Advantage of Rare Leasing Opportunity

After years of sluggish performance, retail property landlords are now benefiting from record-high rent spreads due to tight space availability and strong tenant demand. Following declines after the Great Recession and challenges during the pandemic, retail rents have surged, with new leases seeing increases of up to 35% over expiring ones. Sun Belt markets, such as Nashville and Tampa, have led the growth, with retail rents rising by 70% over the past decade. Though the pace of rent growth has slowed recently, the low availability of space and continued demand suggest that rents will remain elevated for the near future.

Weak demand hampers commercial property price growth

Commercial property prices are struggling due to reduced tenant demand, despite an expected interest rate cut from the Federal Reserve. Prices are projected to remain flat at best until tenants start leasing more space than they are vacating. Over the past year, there has been a drop in demand for office, industrial, and retail space combined, with an estimated 13.2 million square feet more emptied than newly leased in the 12 months ended in August. The value-weighted index for high-dollar deals increased slightly in August, while the equal-weighted index for lower-priced deals fell, indicating mixed reactions in different market segments.

Invitation Homes to pay $48 million settlement for what FTC calls ‘deceptive tactics’

Invitation Homes, the largest U.S. single-family rental landlord, settled a $48 million case with the FTC over allegations of deceptive practices, including hidden fees, unfair eviction policies, and improperly withholding security deposits. The settlement, aimed at refunding harmed renters, requires the company to improve transparency in lease pricing and security deposit handling. The FTC alleged Invitation Homes overcharged renters with undisclosed fees and engaged in unfair eviction practices during the COVID-19 pandemic. Despite the settlement, Invitation Homes maintains it committed no wrongdoing and continues to focus on improving customer experiences. This case highlights growing scrutiny of corporate landlords amid rising housing costs.

Here’s how Macy’s strategy of leaving malls, selling stores plays out in Georgia

Macy’s is actively reshaping its retail strategy by selling off its department stores in Georgia, notably including the recent sale of its Gwinnett Place Mall location for $16.5 million to Gwinnett County, which plans to transform the area. This move aligns with Macy’s broader initiative to exit traditional mall spaces and focus on smaller-format stores, aiming to adapt to changing consumer behaviors and enhance profitability. The company is leasing back the sold location, allowing it to maintain a presence while reducing its real estate footprint.

Atlanta skyline office tower could get some of the highest apartments in US Southeast

By Paul Owers CoStar News Summary: The Georgia-Pacific Center in downtown Atlanta is set to undergo a major transformation, converting its top floors into more than 400 rental apartments, making them among the highest in the U.S. Southeast. The redevelopment will also...

Invitation Homes spends $216 million on build-to-rent projects in 60 days

Invitation Homes, the largest single-family home landlord in the U.S., reported over $200 million in investment activity in the third quarter of 2024. The company entered agreements to acquire 580 homes in Tampa, Denver, and the Carolinas, most of which were already completed. The acquisitions underscore the company’s strong relationships with homebuilders, as it continues to grow its build-to-rent portfolio, with plans to invest $1 billion in home purchases in 2024. Additionally, Invitation Homes secured a new $3.5 billion credit facility to refinance previous debt at a lower interest rate. Despite potential slowdowns in build-to-rent construction, Invitation Homes sees ongoing demand in its markets, driven by a lack of housing supply.

Convenience store and gas station owner Parkland to sell Florida portfolio

Parkland, a Canadian fuel supplier and convenience store owner, is selling its Florida business, including 100 retail locations, as part of its strategy to divest non-core assets. This move aligns with the company’s broader goals of organic growth, cost reduction, and supply chain optimization. Despite challenges in the U.S. market, particularly in fuel volume declines and job cuts, Parkland aims to focus on higher-return opportunities and maximize shareholder value. The Florida sale is expected to be completed over the next 12 to 18 months, with no broker yet identified. Parkland’s U.S. retail portfolio will be cut in half following the sale.

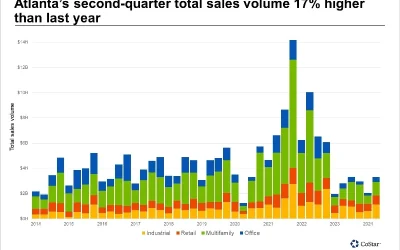

Atlanta commercial real estate sales jump nearly 20% year over year

Atlanta’s commercial real estate market saw a nearly 20% increase in investment sales volume in Q2 2024 compared to the same period in 2023, despite overall transactions lagging behind pre-pandemic levels. Growth was driven by multifamily and retail sectors, with multifamily sales rising 29% and retail up 37%. However, office sales declined by 10%. Out-of-state investors, accounting for over 80% of buyer volume, played a significant role in the market. While multifamily sales remain lower than historical averages, retail transactions have surpassed pre-pandemic levels. Rent growth has slowed, and capital market challenges continue to limit deal activity.

Growing PulteGroup plans 55-and-over development in coastal Georgia

PulteGroup, a major U.S. homebuilder, is planning a 55-and-over development with around 700 homes near Savannah, Georgia, under its Del Webb brand. The community, called Heartwood, will feature resort-style amenities, including a 9,000-square-foot clubhouse, pools, pickleball courts, and a full-time lifestyle director. PulteGroup anticipates opening a sales center in spring 2025, with homes starting in the $400,000s. The company expects growth of 5-10% in 2025, driven by a nationwide housing shortage and potentially lower interest rates. PulteGroup sees these factors as opportunities to increase sales despite current high mortgage rates.

Residential Real Estate Industry Sees Benefits Emerging From ‘Organized Chaos’ of New Compensation Rules

By Moira Ritter CoStar News Summary: The residential real estate industry is quickly adapting to new compensation rules, which have disrupted traditional practices. These changes, stemming from a legal settlement, require buyer brokers to have signed agreements with...

Federal home loan banks push back against increases to affordable housing grants

By David Holtzman CoStar News Summary: Critics argue that the federal home loan banks are not doing enough to address the housing crisis, despite generating $725 million last year for affordable housing. The 11 banks resist efforts to increase their...

REIT Tells Steward Health To Pay Rent or Leave, Sparking Debate on Hospital Property Use

Steward Health Care System, once the largest for-profit private U.S. hospital network, is embroiled in a legal dispute with its largest landlord, Medical Properties Trust (MPT), over unpaid rent. MPT, which owns nearly all of Steward’s U.S. hospitals, has demanded that Steward either pay rent or vacate the properties, as Steward navigates Chapter 11 bankruptcy. The dispute, which has sparked legislative debate and led to severe maintenance issues at some hospitals, highlights the financial struggles of both entities. Steward seeks to sell its operations, but MPT claims that Steward is unfairly trying to shift real estate value to its own benefit. The conflict has stalled hospital sales and has broader implications for hospital ownership and real estate investment in healthcare.

US House Prices Hit Another All-Time High

U.S. house prices hit a record high in June 2024, marking the fourth consecutive month of increases, with the S&P CoreLogic Case-Shiller Index showing a 5.4% annual rise. Despite the historical peak, the growth in home prices has slowed for the third consecutive month, as seen in both national and metropolitan indices. Economists suggest that while inflation and housing have decelerated, home prices remain significantly above historical norms. The Federal Housing Finance Agency’s data also indicates a slowdown in house price growth, likely influenced by increasing housing inventory and high mortgage rates. The effects of recent interest rate cuts by the Federal Reserve may be reflected in future reports.

Mortgage Applications Hit Highest Level Since 2023 as Borrowers Take Advantage of Easing Rates

Mortgage applications have surged to their highest level since January 2023 as borrowers take advantage of easing mortgage rates. The Mortgage Bankers Association reported a 17% increase in applications for the week ending August 9, driven by a 35% jump in mortgage refinances, which are up 118% from a year ago. The average 30-year fixed-rate mortgage dropped to 6.47%, its lowest level since May 2023, sparking renewed interest in both refinancing and new home purchases. Economists expect this trend to continue, especially if the Federal Reserve cuts interest rates in the near future.

Hyatt Nears End of $2 Billion Hotel Asset Sale Plan, Plans Brand Acquisitions

By Sean McCracken Hotel News Now Summary: Hyatt Hotels Corp. will remain active in the transactions market after completing a $2 billion hotel sales commitment. CEO Mark Hoplamazian highlighted the focus on strategic partnerships and acquisitions of hotel brands or...

Blackstone Alone Could Take CMBS Issuance Higher, Loan Downgraded on Twin Chicago High-Rises, Retail Property Values Fall Furthest Among Distressed Loans

Blackstone’s activities have the potential to significantly boost the issuance of commercial mortgage-backed securities (CMBS). Meanwhile, a loan for two high-rise buildings in Chicago has been downgraded, reflecting issues in that market. Additionally, retail property values have experienced the steepest declines among distressed loans, indicating ongoing struggles in the retail sector.

This $5 Billion Project Was Going To Start With Offices. Then the Developer Had Another Idea.

By Tony Wilbert CoStar News Summary: CIM Group adapted its $5 billion development plans for Centennial Yards in downtown Atlanta by shifting focus from office buildings to hospitality, a move deemed essential for success by Brian McGowan, CIM's Centennial Yards Co....

Macy’s Closings Could Raise Risk for Billions in CMBS Mall Debt

A bidding war for Macy’s, concurrent with the retailer’s plan to close 150 stores, has significant implications for shopping mall owners and the loans financing these centers. While a buyout could be beneficial with a financially strong new owner, closures may spell trouble for malls and lenders. Macy’s anchors numerous malls, totaling over 100 million square feet, with about $24 billion in loans linked to these properties. The potential closure of Macy’s stores could lead to reduced foot traffic, lower sales for neighboring tenants, and decreased revenue for landlords. Weaker-performing malls are likely targets for closures, exacerbating their decline. Co-tenancy clauses triggered by anchor store closures could affect inline tenants, potentially leading to reduced rents or concessions. Overall, these developments indicate possible repercussions for mall viability and associated loans.

More Than 16,000 NYC Hotel Rooms Used To Accommodate Unhoused

In response to the housing needs of the unhoused, refugees, and migrants, over 16,000 hotel rooms in New York City have been repurposed, with 140 hotels no longer available for travelers as of October. Various city and county authorities have secured these accommodations through long-term leases, reducing future hotel room supply. The impact is particularly noticeable in different market segments, with a concentration of projects in major areas like midtown, Queens/Brooklyn, and JFK/Jamaica. The transformation of these hotels, most of which were midscale or economy properties, may have a lasting effect on New York City’s hotel performance, potentially leading to higher average daily rates in the future. Despite ongoing construction, the city’s supply pipeline for new hotels is expected to be limited due to recent zoning and development regulations.

Amazon Ratchets Up Warehouse Sublease Offerings Offsetting Newly Leased Space

Amazon has vacated over 14 million square feet of distribution space in the U.S. in the past 16 months, constituting about 3% of its U.S. logistics footprint. Most closures occurred in the latter half of 2022 as Amazon focused on shutting down older, less efficient facilities. The company has recently increased its sublease offerings, with the unique aspect being that more of these involve opportunities through 2030 and beyond in larger, newly built distribution properties. Despite these closures, Amazon’s total U.S. logistics square footage appears to remain stable in 2023, with new leases offsetting the volume of closures.

Consumer Confidence Slips for Fourth Month, Retailers Expand Seasonal Hiring, Jobless Claims Edge Lower

Consumer sentiment in the U.S. declined for the fourth consecutive month, with the University of Michigan’s sentiment index dropping to 60.4 in November, down from 63.8 in October. Concerns about high interest rates, inflation, and global political unrest contributed to the decline, particularly affecting lower-income and younger consumers. Despite retailers adding 3% more jobs in October compared to the previous year in anticipation of the holiday season, transportation and warehousing jobs fell by 27%. Additionally, while initial claims for unemployment insurance remained low at 217,000 for the week ending Nov. 4, continuing claims increased for the seventh consecutive week, suggesting challenges in finding new employment for some individuals.

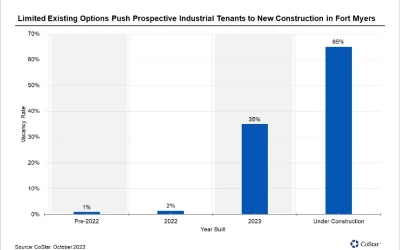

Swollen Construction Pipeline Could Cause Jump in Fort Myers Industrial Vacancy

Fort Myers, in Southwest Florida, has seen significant activity in new industrial development with 3.9 million square feet currently under construction, following the completion of 1.4 million square feet. However, recent completions have surpassed tenant move-ins, leading to a slight increase in vacancy rates to 2.4%, marking the first time the vacancy rate has averaged over 2% in a year. It’s projected that the vacancy rate will continue to rise, potentially peaking at around 6% by the end of 2024. Despite this increase, Fort Myers remains a desirable industrial market with strong tenant interest, particularly for spaces under 50,000 square feet. Vacancy is expected to normalize to 2% to 3% in the long term.

Biden Administration Publishes Guidelines To Encourage Commercial-to-Residential Conversions

54-Page Guide Outlines Federal Resources Available to Developers and Landlords By Parimal M. Rohit, CoStar News Amid a housing shortage in U.S. cities, various initiatives are looking to convert underused office spaces in central business districts into residential...

Hotels Step Up Offerings To Entice Guests Who Travel With Their Pets

Hotels are increasingly offering a range of amenities and services to pamper pet owners and their pet companions. These services go beyond the traditional water bowls and plush beds, with offerings such as nutritious, fresh dog food in hotel restaurants, “Yappy” hours, play areas, dog mini poolside cabanas, and even doggie turn-down service. Some hotels have specific pet packages, including access to telehealth appointments for pets and dedicated pet concierges, catering to both traditional and non-typical emotional support animals and exotic pets. These pet-friendly amenities aim to enhance the guest experience for pet owners and their beloved animals while contributing to a more comfortable environment for all guests.